Decentralized Finance, or DeFi, is revolutionizing the financial sector by leveraging blockchain technology to eliminate intermediaries, enhance transparency, and provide users with direct control over their assets. This burgeoning sector within the cryptocurrency landscape offers a wide array of financial services traditionally managed by centralized institutions, such as lending, borrowing, trading, and earning interest. Understanding DeFi and its implications is crucial for grasping how it’s reshaping the crypto world.

Key Features of DeFi

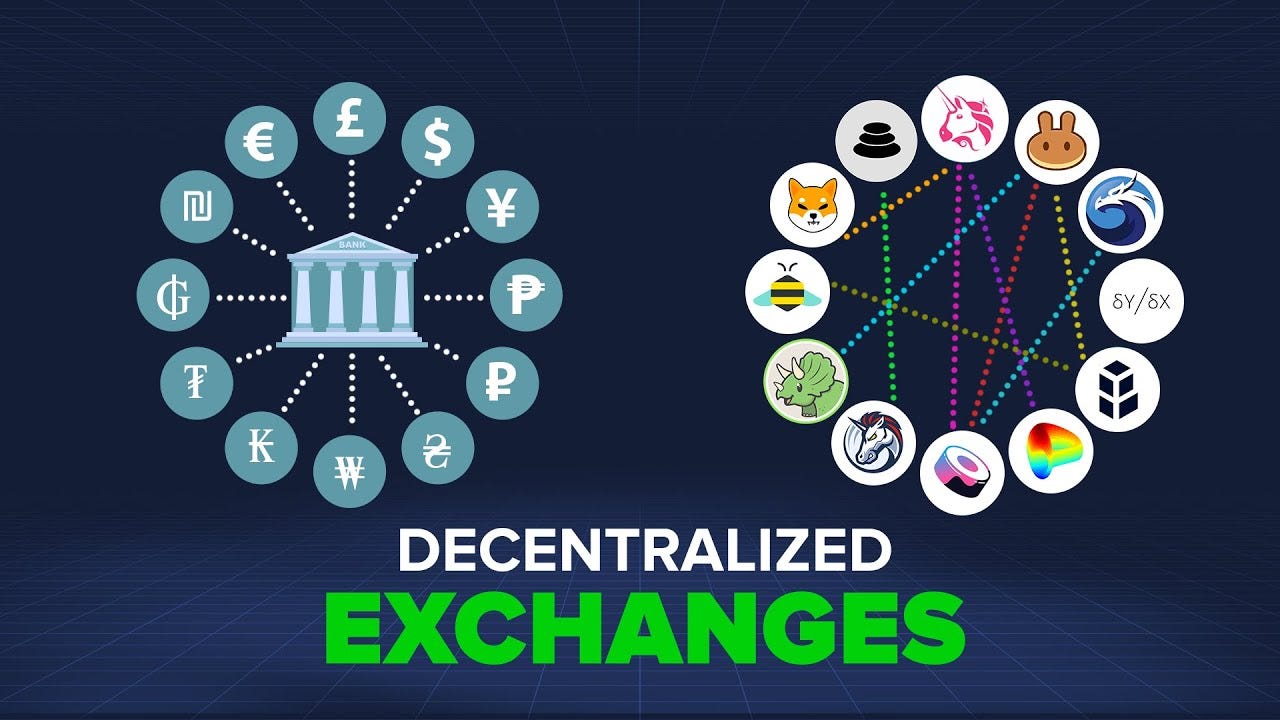

- Decentralization: Unlike traditional finance, which relies on central authorities like banks and brokerages, DeFi operates on decentralized networks using smart contracts. These self-executing contracts, encoded on blockchain platforms such as Ethereum, automate transactions and enforce agreements without human intervention.

- Transparency and Security: DeFi platforms are built on open-source blockchains, ensuring that all transactions are publicly accessible and verifiable. This transparency reduces the risk of fraud and enhances security, as the decentralized nature of blockchain makes it resistant to hacking attempts.

- Accessibility: DeFi democratizes access to financial services. Anyone with an internet connection and a digital wallet can participate in DeFi platforms, bypassing traditional barriers such as credit scores and geographic restrictions. This inclusivity can help bank the unbanked and provide financial services to underserved populations【7†source】.

Major Components of DeFi

- Lending and Borrowing: DeFi platforms like Aave and Compound allow users to lend their crypto assets and earn interest or borrow against their holdings. These platforms use smart contracts to pool funds and distribute interest, ensuring fair and efficient transactions without the need for intermediaries.

- Decentralized Exchanges (DEXs): Unlike centralized exchanges, which act as intermediaries in trades, DEXs like Uniswap and SushiSwap enable peer-to-peer trading directly from users’ wallets. This model reduces the risk of exchange hacks and gives users full custody of their funds.

- Stablecoins: To mitigate the volatility inherent in cryptocurrencies, DeFi utilizes stablecoins—digital currencies pegged to stable assets like the US dollar. Examples include Tether (USDT) and USD Coin (USDC). Stablecoins are crucial for providing a reliable medium of exchange and store of value within the DeFi ecosystem.

- Yield Farming and Staking: Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens. Staking, on the other hand, involves locking up funds to support network operations and earn staking rewards. Both practices offer high returns but come with varying degrees of risk【7†source】.

The Impact of DeFi

DeFi is transforming the crypto landscape by offering innovative financial products and services that are more efficient, transparent, and accessible than their traditional counterparts. It is attracting significant investment and user interest, leading to rapid growth and development in the sector. However, DeFi also faces challenges such as regulatory scrutiny, security vulnerabilities, and the need for broader adoption.

Conclusion

DeFi is at the forefront of financial innovation, providing a glimpse into a future where financial systems are more open, inclusive, and efficient. By eliminating intermediaries, enhancing transparency, and offering unparalleled accessibility, DeFi is poised to continue reshaping the crypto landscape and the broader financial industry. For those interested in the future of finance, understanding and engaging with DeFi is essential.