In today’s unpredictable business environment, resilience is key to survival. From natural disasters and cyberattacks to supply chain disruptions and unexpected closures, small businesses face a growing range of risks. That’s where business interruption insurance comes into play.

For small business owners in the UK and USA, this coverage is no longer a luxury—it’s a necessity. In this article, we’ll break down what business interruption insurance is, why it matters more than ever in 2025, and how to find the right coverage for your business.

What is Business Interruption Insurance?

Business interruption insurance (also known as business income insurance) is a type of policy that helps replace lost income when a business is forced to shut down due to a covered event. It ensures that even when operations are paused, your business can stay afloat financially.

✅ What It Typically Covers:

- Lost revenue during downtime

- Fixed operating costs (rent, utilities, payroll)

- Temporary relocation expenses

- Loan payments

- Taxes

🚫 What It Usually Doesn’t Cover:

- Property damage (covered under commercial property insurance)

- Undocumented income

- Pandemics (some insurers now exclude these)

Why It’s a Must-Have in 2025

1. Extreme Weather Events Are on the Rise

Both the UK and USA have seen a spike in severe weather—flooding, wildfires, storms—which can disrupt operations for weeks. With climate change accelerating, this risk is only increasing.

2. Cyberattacks and Digital Downtime

Small businesses are now prime targets for cybercriminals. A ransomware attack can cripple operations for days or weeks, resulting in major income loss.

3. Supply Chain Disruptions

Post-Brexit trade issues in the UK and global supply chain instability in the US have highlighted how fragile operations can be. A delay in receiving inventory can cause a revenue standstill.

4. More Insurers Are Offering Customizable Coverage

Insurers have adapted post-COVID. Many now offer more tailored plans for small businesses, especially in sectors like retail, hospitality, consulting, and tech.

Who Needs Business Interruption Insurance?

This coverage is especially valuable for small businesses that:

- Operate from a physical location (shops, restaurants, salons)

- Rely on foot traffic or appointments

- Depend on equipment, stock, or inventory

- Are part of a supply chain

- Would struggle to pay bills during a closure

Whether you’re a consultant in Manchester or a cafe owner in Chicago, this insurance can be a financial lifesaver.

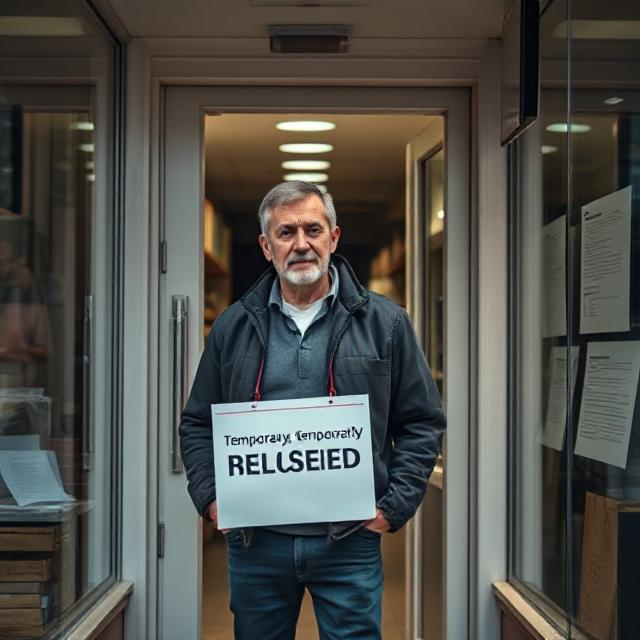

Real-World Example

Case Study: The Coffee Nook – Brooklyn, NY

In 2023, The Coffee Nook suffered a small fire that forced them to close for six weeks. Thanks to their business interruption policy, they were able to cover lost income, keep staff on payroll, and pay rent during repairs. Without it, they may not have reopened.

How to Choose the Right Policy

🔍 1. Evaluate Your Risks

What’s most likely to shut down your business? Fire? Flood? Cyberattack? Tailor coverage to those risks.

🏢 2. Bundle with Commercial Property Insurance

Often, interruption insurance is added as a rider to property insurance. Ask for combined quotes to save money.

💰 3. Check the Indemnity Period

This is the maximum length of time you’ll be compensated for lost income—typically 12, 18, or 24 months.

📜 4. Review Exclusions Carefully

Make sure you understand what is not covered. For example, many policies exclude pandemic-related shutdowns post-COVID.

Cost of Business Interruption Insurance

Premiums vary based on:

- Business size and type

- Location

- Revenue

- Level of coverage and indemnity period

On average, small business owners can expect to pay:

- UK: £250–£750/year

- USA: $500–$1,500/year

(When bundled with other commercial policies)

Top Providers in the UK & USA (2025 Update)

🇬🇧 UK Providers

- AXA Business Insurance

- Simply Business

- Hiscox UK

- Direct Line for Business

🇺🇸 US Providers

- Hiscox USA

- The Hartford

- NEXT Insurance

- Nationwide

Final Thoughts: Is It Worth It?

Absolutely. Business interruption insurance isn’t just another line on your balance sheet—it’s a critical part of protecting everything you’ve built. In an era where disruption is the norm, having a financial buffer means you can bounce back faster, retain your team, and maintain customer trust.

Whether you’re just starting your business journey or scaling up, now is the time to assess your insurance needs and protect your future.

FAQs

Q: Is business interruption insurance tax-deductible?

A: In most cases, yes—insurance premiums for business-related coverage are considered a business expense.

Q: Does it cover COVID-related closures?

A: Most new policies now exclude pandemic-related interruptions. Check your policy wording carefully.

Q: Can freelancers or consultants get this insurance?

A: Yes, especially if their income depends on consistent operations or client interactions.